Falling Milk Prices in 2026: What Does This Mean for Dairy Ingredient Traders?

The global dairy market is facing continued pressure in early 2026. Milk prices have declined in several regions, particularly in Europe, while early signs of recovery are emerging on the global market. For traders in dairy ingredients such as milk powder, butter, cheese, and other dairy commodities, this creates a challenging yet opportunity-driven environment.

In this article, we explore:

- current trends in global milk prices,

- the impact on dairy commodity and ingredient traders,

- and how a specialized ERP system for dairy trade, such as Moo Software, can help businesses stay in control in a volatile market.

Global Milk Price Trends: Pressure with Early Signs of Recovery

At the start of 2026, global milk prices present a mixed picture.

- Europe: Milk prices have fallen for the fifth consecutive month. High production levels and ample supply continue to put pressure on the market. A meaningful recovery is not expected until later in 2026.

- Global market (GDT): The Global Dairy Trade auction has shown modest price increases, suggesting that the prolonged downward trend seen in 2025 may be coming to an end.

- Underlying causes: Record milk production, increased output in the United States, and delayed buying behaviour from end users have resulted in oversupply and downward price pressure.

While farmers mainly experience the impact at the farm-gate level, dairy traders face rising volatility and commercial uncertainty.

The Impact of Falling Milk Prices on Dairy Ingredient Traders

Declining milk prices directly affect margins, inventories, and risk exposure for traders in dairy ingredients.

- Inventory devaluation

Stock purchased at higher price levels can quickly lose value in a declining market. This puts immediate pressure on profitability and highlights the importance of accurate inventory valuation and turnover. - Cautious buyers

In falling markets, buyers often delay purchases in anticipation of further price drops. This behaviour can temporarily reduce trading volumes and liquidity across the supply chain. - Increased price volatility

Oversupply and uncertainty lead to sharper and more frequent price movements. For traders, this increases the risk associated with long-term contracts and open positions. - Stronger focus on risk management

To protect margins, traders increasingly rely on futures and hedging strategies. Understanding open positions and exposure becomes critical to making timely decisions. - Export opportunities

Lower prices in Europe and the United States improve competitiveness on the global market, opening opportunities in regions such as Southeast Asia, the Middle East, and Africa.

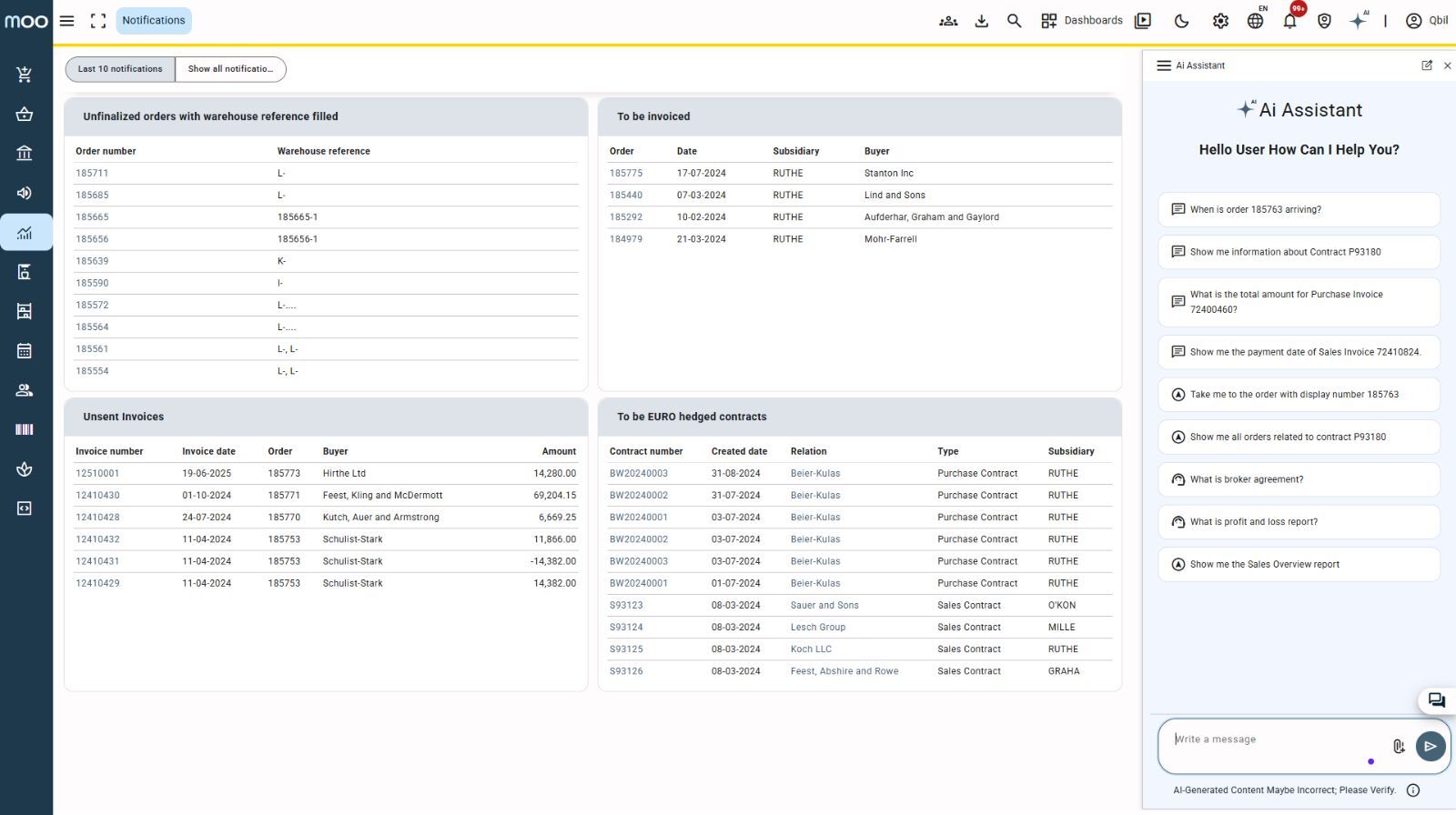

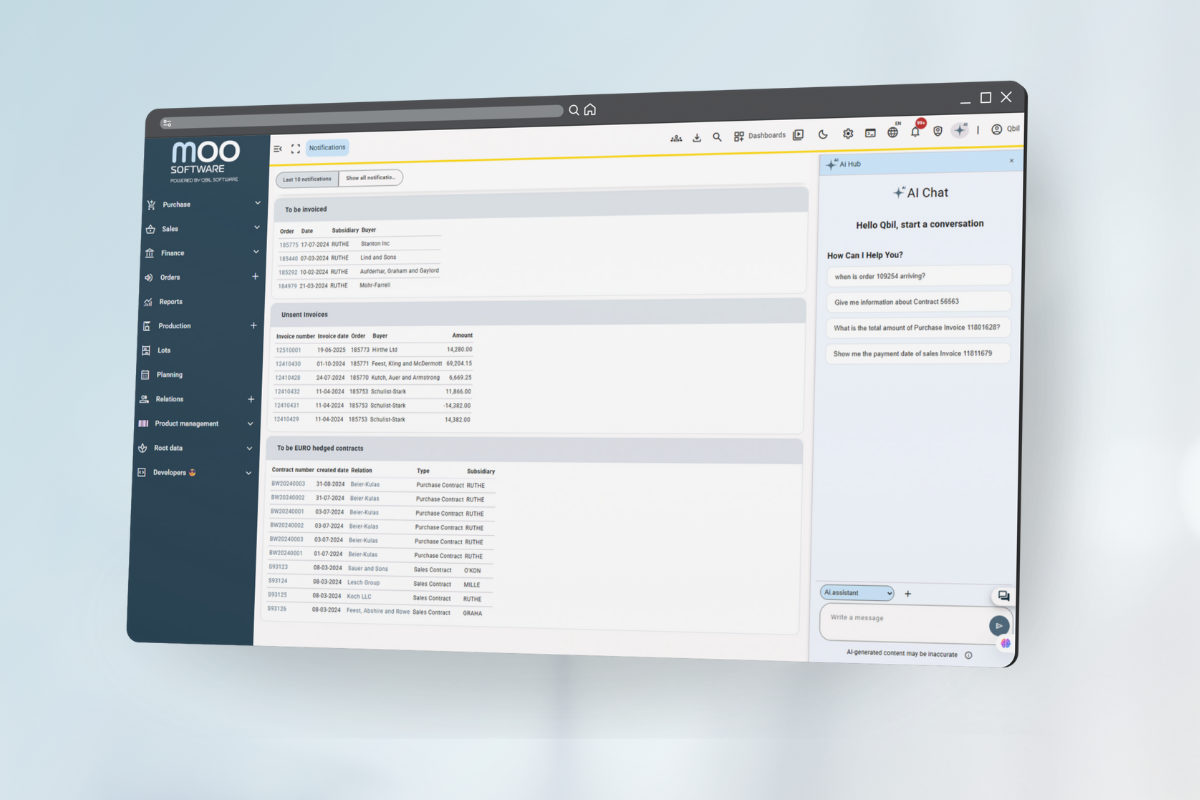

How a Specialized ERP System Supports Dairy Traders

In a market characterised by falling and volatile prices, real-time insight is essential. An ERP system designed specifically for the dairy trade acts as the operational backbone of a trading organisation.

Real-time visibility into margins and contracts

When prices move quickly, margins can disappear before you notice. With a specialized ERP like Moo Software, purchase and sales contracts are managed centrally, providing immediate insight into commercial exposure and expected results.

Smart inventory management and shelf-life control

Declining prices increase the financial risk of holding inventory. By supporting strict stock control principles such as FEFO (First Expired, First Out), an ERP system helps traders:

- sell older or higher-priced stock first,

- reduce waste and write-offs,

- and limit capital tied up in inventory.

Clear overview of trading positions and risk

Every dairy trading business needs to know its net position at all times. A specialized ERP system provides real-time insight into:

- physical stock,

- goods in transit,

- committed sales,

- and open purchase contracts.

This enables traders to quickly assess their exposure and respond proactively to market movements.

Support for dairy-specific product characteristics

Dairy ingredients are defined by specific quality parameters such as fat content and dry matter. Moo Software is built with in-depth knowledge of dairy trade processes and supports these product characteristics across contracts, logistics, and administration—without relying on error-prone manual handling.

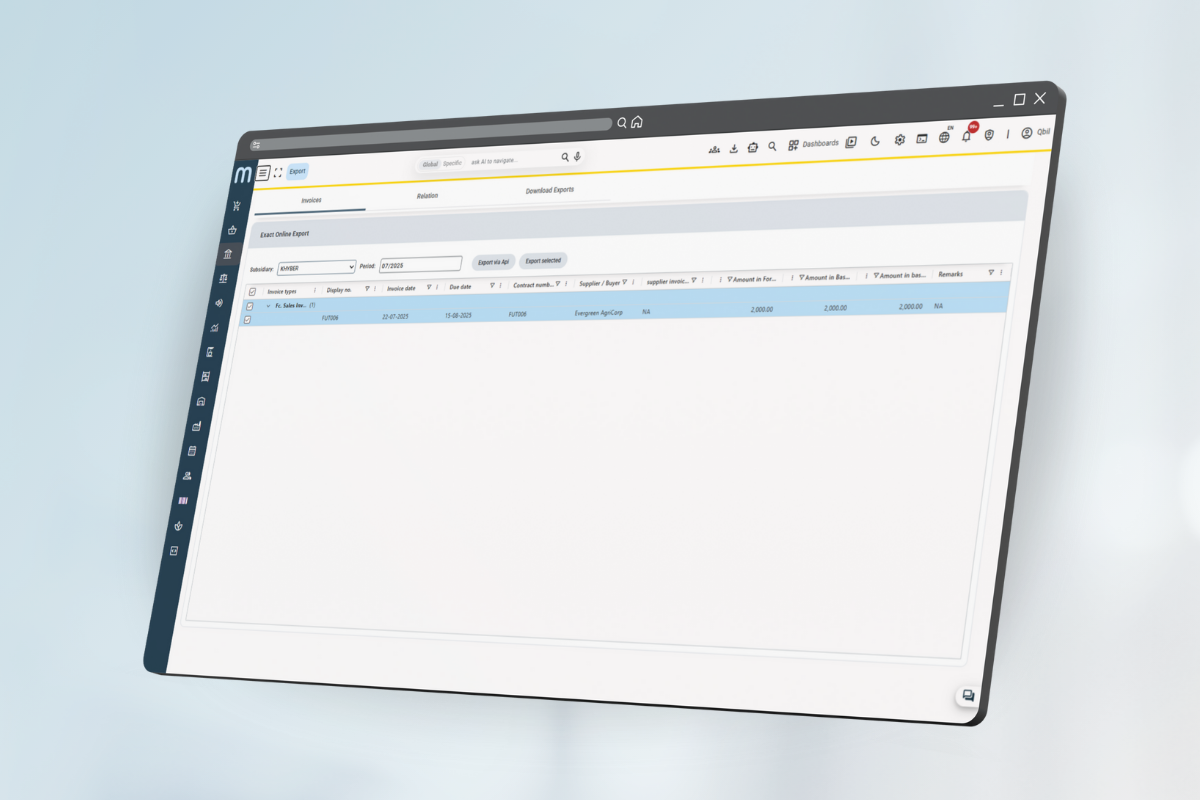

Improved cash flow and liquidity management

Falling prices can put pressure on cash flow. By integrating financial data with logistics and contract management, an ERP system provides forward-looking insight into:

- incoming payments,

- supplier obligations,

- and overall liquidity.

This allows traders to remain financially stable, even in turbulent market conditions.

Conclusion: Control as a Competitive Advantage in Dairy Trade

The current dairy market requires caution, speed, and transparency. Falling milk prices increase commercial risk but also create opportunities for traders who have their operations under control.

With an ERP solution specifically developed for dairy ingredients trading, such as Moo Software, traders gain:

- real-time insight into margins and positions,

- stronger control over inventory and liquidity,

- and the agility to respond quickly to market changes.

In a volatile dairy market, control is not just an operational benefit—it is a strategic advantage.